One-stop-shop: Finance,

Tax and Legal

Subjects

NEWS

Prince’s Day: Tax plan 2023

On Prince’s Day, the Dutch government presented its tax plans for voor 2023. We would like to inform you below about the most important matters, but with one proviso: this newsletter has been prepared on the basis of the Tax Plan. The definitive legislation may be different.

Income tax

The rate of the first bracket in box 1 will decrease from 37.07% to 36.93% (2023: up to an income of EUR 73,031, 2022: up to an income of EUR 69,398). For the excess, the rate will stay the same (49.50%). In concrete terms, this change means that (slightly) less income tax needs to be paid.

If you have a strongly fluctuating income, you may be able to use, subject to certain conditions, the “averaging scheme” (middelingsregeling). In that case, your income for the last three years is averaged, so that less tax is payable. This may result in a tax refund. The last period in respect of which incomes can be averaged is 2022/2023/2024.

The deduction for self-employed persons (zelfstandigenaftrek) is an amount that can be deducted by entrepreneurs who meet the hours criterion. The main rule here is that at least 1,225 hours must be worked for the business per year. The deduction for self-employed persons will be decreased in 2023 to EUR 5,030. The deduction for starting entrepreneurs continues to be EUR 2,123.

The fiscal retirement reserve (fiscale oudedagsreserve) is a tax facility in order to defer taxation. By building up the reserve now, a deduction is created which results in less tax becoming payable. This reserve must be lifted and added to the profit again when the business is discontinued at the latest, so that tax will have to be paid on it after all. After 1 January 2023, the fiscal retirement reserve cannot be built up (any further).

The items that are tax-deductible, such as the exemption for small and medium-sized businesses, mortgage interest, health care costs and gifts, can be deducted at a maximum rate of 36.96%. This meant that these items will decrease the taxation in box 1 less heavily. This limitation does not apply to any annuity or disability insurance.

The tax-free travel allowance for business kilometres and commuter traffic will be increased. It is now still EUR 0.19 per kilometre, but will go up to EUR 0.21 per kilometre in 2023.

If a company car is also used for private purposes, tax must be paid on this use, which is referred to as the addition (bijtelling). For zero-emission cars, the percentage of the addition is 16% of the catalogue price up to EUR 30,000; for higher prices, the regular percentage of 22% applies. In the year in which a new car is purchased, the then applicable percentage continues to apply for 60 months. This looks as follows in numbers:

| Year | Discount | Addition | Maximum catalogue price discount | Excess | Maximum advantage |

| 2022 | 6% | 16% | EUR 35,000 | 22% | EUR 2,100 |

| 2023 | 6% | 16% | EUR 30,000 | 22% | EUR 1,800 |

| 2024 | 6% | 16% | EUR 30,000 | 22% | EUR 1,800 |

| 2025 | 5% | 17% | EUR 30,000 | 22% | EUR 1,500 |

| From 2026 onwards | None | 22% | Not applicable | - | - |

The income-dependent combination discount will be abolished in 2025, but the general tax credit and the employment credit will be increased with effect from 2023.

Box 3 (capital)

Capital is currently taxed (in box 3) on the basis of fictitious returns. Following the court judgment of December 2021, it has been established that these fictitious returns differ too much from reality in specific cases. That is why the government now intends to change the taxation of capital. How and when this will be changed is not clear yet and must be shaped in the years to come. One thing that is certain is that tax on rental properties (held in private) will go up. This will only apply in cases where rent protection is available. If no rent protection is applicable, 100% of the WOZ (property) value had to be included and must still be included. If rent protection exists, the value of the rental property/properties must be determined by multiplying the WOZ value by the so-called vacant value ratio. In 2023, the vacant value ratio in cases where the annual rent is higher than 5% of the WOZ value is increased to 100% of the WOZ value. The rent that is received is not taxed.

The changes as per 1 January 2023 will now be shown in numbers:

If the WOZ value is EUR 300,000 and the base rent in January 2023 is EUR 975 (per year: EUR 975 x 12 months = EUR 11,700), then the vacant value ratio is 3.9% (EUR 11,700 / EUR 300,000). This means that EUR 300,000 x 90% = EUR 270,000 must be reported as capital in the income tax return. If the rent is EUR 1,300, the vacant value ratio is higher than 5%, so that the WOZ value of the rental property must be reported for 100% (EUR 300,000) as capital in the income tax return.

Share options

Sometimes employers grant employees share options instead of a normal salary. This is mostly the case for start-ups and scale-ups, which do not have sufficient funds to be able to pay higher salaries. A share option entitles the employee to buy shares in the company during a number of years, for a pre-determined price. A share option is a form of salary, so that tax must also be paid on it. Currently, that tax is levied at the time the employee exercises his option by actually converting it into shares. At that time, the employee must also pay tax, while often the employee does not have any money to do so. From 1 January 2023 onwards, the main rule is that tax will only be levied at the time the shares are marketable, so that funds do or may become available to pay the tax that is due.

Corporation tax

In 2023, the corporation tax rate for profits up to EUR 200,000 (2022: EUR 395,000) will be increased to 19% (2022: 15%); for the excess the rate continues to be 25.8%. If profit expectations are high, it may be worthwhile to divide the profits among several (new) companies.

If this profit is then paid to the shareholder(s) as dividend, this amount will be taxed for a total of 26.9%. The effective rate will be as follows in the case of a dividend payment:

| Taxation | Profit ≤ EUR 200,000 | Profit> EUR 200.000 |

| Profit of company | 100.0% | 100.0% |

| Corporation tax | -19.0% | -25.8% |

| Net profit | 81.0% | 74.2% |

| Tax on dividend (26.9%) | -21.8% | -20,0% |

| Net dividend | 59.2% | 54.2% |

| Effective rate | 40.8% | 45.8% |

For 2024 it is expected that two brackets will be introduced: for a total annual dividend of EUR 67,000, a rate of 24.5% will apply. For the excess a rate of 31.0% will apply.

Borrowing from your own company

It is possible to borrow money from your own company. From 2023 onwards, the amount cannot exceed EUR 700,000 (this amount is not doubled for tax partners). Other family members, such as children, may additionally also borrow EUR 700,000 per person from the company; loans for an owner-occupied property, for that matter, do not count here. Please note that the term “owner-couped property” is understood to mean the property that is your main residence. A second home is not considered as an owner-occupied property. For loans to finance owner-occupied properties after 31 December 2022, a mortgage right must be granted to the company (which right must be recorded in a notarial document).

Borrowing more than EUR 700,000 from your own company is permitted, but in that case the excess will be considered as ‘excessive lending’ and will then be subject to income tax as if it were a dividend payment. The first reference date for this new rule is 31 December 2023. If, for instance, you had borrowed EUR 800,000 on 31 December 2023 from your own company to finance a holiday home, you will pay 26.9% in tax on EUR 100,000, viz. EUR 26,900.

Gift tax

The exemption from gift tax of EUR 100,000 (jubelton) for the purchase or renovation of an owner-occupied property will be abolished on 1 January 2023. Use can still be made of the once-only increased exemption of EUR 28,947 that applies between parents/children (between 18 and 40 years).

VAT

The VAT rate for the purchase and installation of solar panels for private individuals will be decreased to 0% with effect from 1 January 2023 to make investments in solar panels for private homes more attractive. Currently, private individuals could in many cases also already recoup that VAT in practice, but there is too much red tape now.

Transfer tax

The transfer tax rate will go up on 1 January 2023 from 8% to 10.4%. That does not apply to owner-occupied properties, for which the standard rate continues to be either 2% or 0% (for buyers up to 35 years paying a purchase price of no more than EUR 400,000). For commercial real estate and investment properties (including rental properties and holiday homes), among other property, the rate will go up to 10.4%.

If you are considering to invest in business premises, you could better do so in 2022 than in 2023, as it will save you 2.4%. Please note that the date of transfer of the property (the date of the notarial deed of transfer) is decisive here, not the purchase date (the date on which the provisional sale and purchase agreement is signed).

UBO register

Please note! This information doesn’t apply to the one man business (“eenmanszaak”), but is applicable to the Dutch limited liability company (“BV”) and the general partnership (“VOF”).

With effect from 27 September 2020, many organisations are required to register their UBOs in the new UBO Register held by the Dutch Chambers of Commerce. The registration has to be finalized the latest on March 27, 2022.

What is a UBO?

The UBO (Ultimate Beneficial Owner) is the person who ultimately owns or controls a business, foundation or association (a “legal entity”).

In the case of a Dutch limited liability company (in Dutch: “BV”), UBOs are:

- persons owning more than 25% of the shares;

- persons holding more than 25% of the voting rights;

- persons who de facto control the business.

Why is a UBO Register being set up?

The UBO Register is an initiative of the European Union which is aimed at including the UBOs of companies incorporated in the Netherlands and other legal entities (see the enumeration below) in a central register and to make this register publicly accessible. With this European transparency measure, the EU seeks to combat money laundering and financing of terrorism.

After 27 September 2020, existing companies will have 18 months to register the information about their UBO/UBOs. Newly incorporated companies must immediately register their UBO/UBOs. The registration has to be finalized the latest on March 27, 2022.

Which organisations have a registration obligation?

The registration obligation applies to the following entities:

- private limited liability companies (in Dutch: “BV’s”);

- public limited companies (in Dutch: “NV’s”);

- associations (in Dutch: “verenigingen”);

- mutual guarantee societies (in Dutch: “onderlinge waarborgmaatschappijen”);

- cooperative associations (in Dutch: “coöperaties”);

- professional partnerships (in Dutch: “maatschappen”);

- general partnerships (in Dutch: “VOF’s”);

- limited partnerships;

- shipping companies;

- SEs (European companies);

- SCEs (European Cooperative Societies);

- EEIGs (European Economic Interest Groupings); and

- churches.

Which organisations do not have a registration obligation?

No registration obligation applies to:

- One man businesses (in Dutch: “eenmanszaken”);

- Listed companies and their 100% (direct or indirect) subsidiaries;

- Homeowners Associations (in Dutch: “VVE’s”); and

- Associations with limited legal personality that do not run a business and legal persons created under public law.

In some cases, an exception can be granted for the registration obligation, viz. if registration would subject the UBO to the risk of fraud, kidnapping, blackmailing, violence or intimidation or if the UBO is a minor or is legally incapacitated otherwise.

Which information is registered and made publicly accessible?

The following UBO information will be made publicly accessible:

- name;

- month of birth;

- year of birth;

- state of residence;

- nationality; and

- nature and size of the interest held.

The documents submitted to the Chamber of Commerce, such as passports and partnership agreements, will not become publicly accessible.

For every UBO the following data can only be accessed by the Netherlands Financial Intelligence Unit (FIU-Nederland) and competent authorities, such as the tax authorities, FIOD (Netherlands Fiscal and Investigation Service) and AFM (Netherlands Authority for Financial Markets):

- BSN number;

- Date of birth, place of birth, country of birth and home address.

These authorities can also access the documents submitted to the Chamber of Commerce.

What will happen if a business fails to (timely) register its UBO/UBOs?

The maximum penalty or fine to be forfeited by a business in the case of failure to (timely) register a UBO is EUR 21,750. It is also possible (in exceptional situations) that a prison sentence not exceeding two years is handed or that community service is ordered.

Do you need help?

If necessary, we can of course help you to register the UBO/UBOs. If you have any questions, you know where to find us!

Team Holthaus Legal!

Newsletter Coalition Agreement

Dear client,

After no less than 271 days of negotiations, the new coalition agreement “Omzien naar elkaar, vooruitkijken naar de toekomst” (“Caring for each other and looking ahead”) of Mark Rutte’s fourth cabinet is finally a fact! Below we will update you about the most important tax measures in the coalition agreement. We will also set out the tax rates for 2022 that are most relevant to you.

With effect from 2022:

Home working allowance

With effect from 2022, employers may pay their employees a tax-free home working allowance (in Dutch: “thuiswerkvergoeding”) of €2 per day. The tax-free home working allowance can also be applied if an employee works from home for part of the day. The home working allowance may not be applied in addition to the tax-free travel allowance of €0.19 per kilometre. In that case a choice must be made which allowance will be applied for that day.

First steps towards abolition of benefits system and simplification of tax system

Due to the complexity of the current Dutch benefits system (in Dutch: “toeslagenstelsel”), the government wishes to make steps to abolish the benefits. The current Dutch tax system has also become too complex. It is the government’s ambition to reform and simplify the tax system.

New legislation introducing compensation in the case of errors by the tax authorities

If people suffer harm as a result of any wrongful action or omission by the tax authorities and end up in a difficult situation, it may be appropriate to offer compensation. For this purpose, new legislation will be introduced in 2022.

New Inspectorate: Tax, Customs and Benefits

The new Inspectorate within the Tax, Customs and Benefits domain will start up in 2022. The aim of this Inspectorate is to help rebuild society’s confidence in the government by means of investigations and recommendations. At the end of 2022, the activities of the new Inspectorate will be assessed.

Costs of studying/education no longer tax-deductible

With effect from 2022, the costs of studying and other educational costs can no longer be deducted via the personal income tax return. Instead, a subsidy scheme for education and development will be introduced: the STAP Budget (STAP stands for “Stimulering Arbeidsmarktpositie”, meaning improvement of labour market position). This subsidy can be used by employees to follow training, courses or education in order to remain employable. With effect from 1 March 2022, both employees and jobseekers can apply for a STAP budget with a maximum of €1,000.

VAT exemption on mind sports discontinued

As per 1 January 2022, the VAT exemption for mind sports organisations is discontinued. Mind sports are no longer considered as active sports due to their negligible physical component. For this reason, the regular 21% VAT rate will apply with effect from 1 January.

Buy-up protection

From 2022 onwards, municipalities can prohibit that properties are rented out after being sold. Properties can only still be rented out then subject to strict conditions. The aim of the buy-up protection is to prevent properties from being bought up by investors.

Increase in income addition for company car for tax purposes

Entrepreneurs or employees who also use their company car for private purposes must add an amount to their income for tax purposes that is based on the car’s list price. The normal rate is 22%, but for all cars with zero CO2 emissions, a lowered rate of 16% applies (2021: 12%). This low percentage applies up to a list price of €35,000 (2011: €40,000); the excess is taxed at 22%. This maximum list price does not apply to hydrogen cars or solar cell cars.

Increase in environmental investment deduction

The percentages for the environmental investment deduction (in Dutch: “milieu-investeringsaftrek”) will increase to 17%, 36% en 45%, depending on the type of investment. This rate change serves as an additional incentive for companies to invest in specific environmentally friendly installations, devices or means of transport.

Private addresses no longer visible in trade register

It will no longer be possible to obtain the private addresses of entrepreneurs via the trade register held by the Chamber of Commerce. This is to protect the privacy of entrepreneurs. The place of business can still be obtained. If the business address is the same as the private address, the private address will continue to be visible.

Taxation in the case of shares in start-ups

In the case of share options, employees obtain the right to acquire shares at a lower value or for no consideration, but they must pay tax on the actual value of the shares at the time of conversion. From 2022 onwards, however, employees of start-ups may opt to pay tax on their options at a later moment. Instead of paying the tax at the time the options are converted into shares, they may choose to pay tax at the time the shares become negotiable.

Working disability contribution

The mandatory working disability contribution (in Dutch: “arbeidsongeschiktheidspremie”) used to be the same for all companies (it applied only to employees, and not to shareholders with a controlling interest). From 2022 onwards, the contribution is lowered to 5.49% for small employers and increased to 7.05% for large employers.

Minimum wage

The minimum wage for employees aged 21 years and older has increased to €1,725 gross per month, based on full-time employment.

Income tax rates

The rates for personal income tax in box 1 (earned income and income from an owner-occupied property) are lowered stepwise. For 2022, the rate for income up to €69,399 is 37.07% (2021: 37.1%); any income above this amount is taxed, just as in in 2021, at a rate of 49.50%.

Tax credits

The general tax credit (in Dutch: “heffingskorting”) lowers the income tax that has to be paid. The general tax credit has been increased in 2022 compared to 2021. The employment credit has also been increased. As a result, people who work (both employees and self-employed persons) will pay less income tax.

Self-employed persons’ deduction

The self-employed persons’ deduction (in Dutch: “zelfstandigenaftrek”) has been lowered to €6,310 (2021: €6,671). In the coming years, it will be phased out more quickly to an amount of €1,200 in 2030. Entrepreneurs with a one-person business can claim this deduction, if they work at least 1,225 hours per year and spend more than 50% of their (working) time on their own business.

Deduction percentage for deductible items lowered

The maximum rate at which certain deductible items (including the mortgage interest deduction, the self-employed persons’ deduction and the profit exemption for small and medium-sized businesses) can be deducted is 40% in 2022 (2021: 43%). This means that deduction is not possible at the highest income rate of 49.50% (see above).

Corporate income tax rate

In 2022, corporate income tax must be paid at a rate of 15% on profits up to €395,000 (2020: up to €245,000). Any profit above this amount is taxed at 25.8% (2021: 25%).

Box 3 based on real returns on savings and investments

Income from savings and investments is taxed in box 3. The box 3 system was heavily criticised in recent years, because it was based on a fictitious return that was unrealistic for many people. The Dutch Supreme Court recently found that the box 3 taxation for the years 2017 and 2018 constitutes a violation of the European Convention on Human Rights (ECHR). It can only be repaired by considering the real returns on savings and investments in the taxation. At this point, it is not clear yet how the tax authorities will compensate this and which tax-payers will be eligible for compensation.

The Rutte IV government intended to introduce a new box 3 system based on real returns in 2025. It is expected that this process will be accelerated by the recent Supreme Court judgment.

With effect from 2023:

Limit for excessive borrowing changed from €500,000 to €700,000

As a result of the bill on excessive borrowing, unlimited borrowing by entrepreneurs from their own private companies (in Dutch: “bv’s”) is no longer possible. The limit for the amount that may be borrowed has been increased from €500,000 to €700,000. The consideration by Parliament of the bill on excessive borrowing was temporarily halted, but the bill is expected to be adopted in 2023. From that time onwards, any loan amount in excess of €700,000 will be considered as a fictitious profit distribution and tax must be paid on it at a rate of 26.9% on balance.

Transfer tax to increase

In order to give first-time buyers better chances on the property market, a once-only exemption from Dutch transfer tax (in Dutch: “overdrachtsbelasting”) was introduced with effect from 1 January 2021. For property buyers aged 18 to 35 who buy a property with a maximum value of €400,000, a once-only exemption from the 2% transfer tax applies, if they buy a property they are going to live in themselves. The exemption applies to every buyer individually. If one of the buyers is older than 35, that person must pay transfer tax at a rate of 2% for his/her share.

Buyers who are not going to live in the property themselves must pay transfer tax at a rate of 8%. This applies, for example, to a second home to be rented out to third parties, but also to a holiday home or a property parents buy for their children. With effect from 1 January 2023, the rate will go up from 8% to 9%.

Averaging scheme abolished

Tax payers could make use of the averaging scheme (in Dutch: “middeling”) if they had strong fluctuations in their income. With an averaging request, the average income for three consecutive years is calculated, after which a calculation is made of how much tax must be paid per year. Is this tax lower than the tax already paid? In that case there may be an entitlement to a refund. This averaging scheme will be abolished with effect from 2023.

With effect from 2024:

Abolition of € 100,000 gift tax exemption for donee’s own property

The gift tax exemption for the donee’s own property permits a once-only tax-free gift of €100,000 (in Dutch: “jubelton”). The increased gift tax exemption applies to donees aged 18 to 39. The condition to be satisfied for the exemption is that the gift is spent on the donee’s own property. This increased gift tax exemption will be abolished with effect from 2024.

Increase in tax-free travel allowance

The tax-free travel allowance of €0.19 will be increased with effect from 2024.

Corona support measures at the end of 2021 & 2022

- NOW - Q1 2022

NOW (temporary emergency bridging measure for sustained employment, in Dutch “Tijdelijke Noodmaatregel Overbrugging Werkgelegenheid”) provides for a compensation of the salary costs. If you are expecting a loss of revenue of at least 20% in Q1 2022, you can submit an application for a compensation of 85% of the salary costs of your staff to the UWV (the Dutch Employee Insurance Agency, in Dutch: “Uitvoeringsinstituut Werknemersverzekeringen”). You will only be eligible for NOW if you continue to pay your staff for 100%. The UWV will grant a maximum compensation of 80% of the loss of revenue. Salaries above EUR 9,538 gross per month are not eligible for compensation. In addition to the salary compensation, employers who make use of NOW will also receive an additional compensation for the monthly accrual of holiday pay, pension contributions and employer contributions.

How to apply

It is not yet possible to apply for the NOW Q1 2022. It is expected that applications can be submitted from February onwards. It is still possible to apply for the NOW Q4 2021; this can be done up to and including 31 January 2022. The application must be submitted to the UWV. If you need help with your application, you can always contact us.

When NOW is determined in retrospect, an auditor’s report or a statement of a third-party expert may be required for the final determination of the compensation.

- If you have received an advance of more than EUR 100,000 or a fixed compensation of more than EUR 125,000, an auditor’s report is required. If the fixed compensation exceeds

EUR 375,000, there are additional requirements that the auditor’s report must meet. - If you have received an advance of more than EUR 20,000 or a fixed compensation of more than EUR 25,000, a statement of a third-party expert is required. Examples of such an expert are an external consultant, external financier, industry organisation or accountant/tax advisor. As a registered tax advisor, Holthaus Advies may also draw up this statement.

- If no auditor’s report is required, checks will be made on the basis of the books and records.

Have you already applied for NOW before? In that case, please bear in mind that the NOW compensation must be definitively fixed. If the NOW compensation was applied for in the first NOW round (March up to and including May 2020) and an advance was received, the compensation had to be definitively fixed prior to 31 October 2021. For the second NOW round (June up to and including September 2020), the compensation must be definitively fixed by 31 March 2022. For the other NOW applications, Q4 2020 up to and including Q4 2021, the amount must be definitively determined by 22 February 2023.

When NOW is determined, an efficiency limit of EUR 500 applies. This means that a repayment will only have to be made, if the overpayment of the subsidy exceeds EUR 500. The UWV can be contacted to arrange for a payment arrangement.

- TVL MKB - Q4 2021 and Q1 2022

For small and medium-sized businesses that are hit hardest by the corona measures, the TVL (contribution towards fixed expenses for small and medium-sized businesses, in Dutch: “Tegemoetkoming Vaste Lasten MKB”) offers relief. These businesses will receive a compensation for their fixed expenses that depends on the size of the business, the amount of the fixed expenses and the percentage of the loss of revenue. The subsidy percentage is 100% of the loss of revenue. The maximum compensation is EUR 550,000 for small and medium-sized businesses and EUR 600,000 for large affiliated businesses. The eligibility requirements for TVL are as follows:

- the business must have been set up and registered with the Chamber of Commerce prior to 30 June 2020;

- the loss of turnover must be at least 20% compared to the reference period (Q4 2019 or Q1 2020);

- For businesses that were registered with the Chamber of Commerce between 1 October 2019 and 30 June 2020, different reference periods apply.

- The business must have a physical establishment outside the entrepreneur’s own home. An exception applies to hospitality companies and itinerant trade (such as driving schools, taxi transport and market traders): in these cases the business address may be the same as the home address.

- The received government support is less than EUR 2.3 million.

- The business was not in financial difficulties on 31 December 2019.

How to apply

You can apply for the TVL Q4 2021 up to and including 28 January 2022 (05.00 p.m.). It is still unknown as of when applications for the TVL Q1 2022 can be submitted. Applications must be submitted via the RvO website, using eHerkenning or DigiD.

- Tozo/bbz

Tozo (temporary bridging scheme for self-employed entrepreneurs, in Dutch: “tijdelijke overbruggingsregeling zelfstandig ondernemers”) was discontinued with effect from 1 October 2021. Just as before the corona crisis, Bbz (Assistance for Self-Employed Professionals Decree, in Dutch: “Besluit bijstandverlening zelfstandigen”) is effective again. Because certain industries are closed, the conditions for the Bbz have now been relaxed. This relaxation applies for the months of January up to and including March 2022. When assessing the income top-up, no wealth test is performed; the income of the entrepreneur’s partner is, however, considered. The Bbz can also be applied for with retroactive effect. When assessing eligibility for the Bbz, municipalities will also look at the viability of the business. The Bbz offers various forms of financing, including an income top-up and a business credit.

How to apply

You can apply for the Bbz in the municipality in which you are living. The possibilities and conditions may differ from one municipality to the next.

The municipality will also ask for a definitive determination of the received Tozo. Most municipalities will send an email about this matter. Please note that if Tozo is not determined, or is determined out of time, the municipality may reclaim the received compensation.

- Relaxation of postponement of tax payment

Entrepreneurs who are experiencing financial difficulties as a result of corona virus can request the tax authorities to grant a special postponement of their tax payments until 1 February 2022. Please note that this is a postponement, not a waiver of tax payment. The postponement applies to the following taxes:

- Personal income tax;

- Corporate income tax;

- Wage tax; and

For income tax and corporate income tax, the assessments concerned are sent after the tax returns have been filed with the tax authorities. For the wage tax and turnover tax, you will receive an additional assessment (in Dutch: “naheffingsaanslag”) if you have failed to pay the tax within the regular payment period. A postponement can only be applied for upon the receipt of the assessment/additional assessment.

Have you already requested a postponement of payment before? In that case the special postponement will be extended automatically. You will receive a letter about this from the tax authorities.

How to apply

A request for a postponement of payment must be submitted to the tax authorities in writing prior to 31 January 2022. In this letter it must be explained what effects the corona crisis is having on the business.

- WHOA On 1 January 2021, the WHOA (Court-Approved Private Settlements Act, in Dutch: “Wet Homologatie Onderhands Akkoord”) entered into effect. Although the WHOA is not specifically intended for entrepreneurs hit by the financial impact of the corona crisis, it can offer relief in this situation. If a business is carrying out viable business activities, but has too many debts to be able to continue in existence, a settlement with the creditors can be reached via the WHOA. In the past, a re-start of the business required the agreement of 100% of the creditors. With the WHOA, the creditors can be forced to agree with a lower amount (lower than the outstanding debt). This enables a larger number of businesses to re-start. Please note that the creditors may not be worse off than in a bankruptcy situation if the WHOA is applied. The proposal must be reasonable for all parties and this will be judged by a court.

- TOA If a viable business is realised again by means of the WHOA (point 5), the TOA credit (Time Out Arrangement credit) credit can be applied for. Please note that the TOA credit is not meant to finance the WHOA agreements. The credit is meant to promote the re-start of the business (e.g. for stocks or marketing) and has been capped at EUR 100,000. The maximum duration of the loan is 6 years and within the first twelve months of the loan, no repayments have to be made. Early repayments may be made without any penalty. The interest rate is 2.5%.How to apply

The TOA has been extended and applications may be submitted until 31 May 2024. The application can be submitted to Qredits. - Subsidy scheme for events and ATE

The government has set up a guarantee fund for professional organisers of events taking place between 1 July and 31 December 2021. If an event was cancelled due to corona measures, the government would provide a gift of 100% up to 24 September 2021. After this date, the maximum gift was 80% up to and including 31 December 2021. For the other costs (20%), a loan could be taken out. For cancelled events up to and including December 2021, a proposal has been made that provides for additional compensation (Additional Compensation for Events, in Dutch: “Aanvullende Tegemoetkoming Evenementen”).

How to apply

Applications for ATE cannot be submitted yet. It is expected that applications for ATE can be submitted to RvO with effect from the end of January 2022.

In addition, the subsidy scheme for events has been extended up to and including September 2022. The maximum compensation is 90% for events in the first quarter of 2022; for the remaining costs (10%), a loan can be taken out. For events in the second and third quarters of 2022, a maximum compensation of 80% applies, with the possibility of borrowing the other costs (20%).

The event must satisfy the following conditions:

- the event has a cancellation insurance;

- the event must have been cancelled due to the corona measures. If you decide to cancel the event yourself, there is no entitlement to the subsidy.

The further conditions for the extended guarantee scheme are yet to be announced.

How to apply

The scheme is currently being reviewed by the European Commission. More information will follow.

We will keep a close eye on the above-mentioned schemes and keep you informed about the developments. Please be aware that the corona support measures keep changing. So for your specific situation, please contact us. If you wish, we can of course help you with the applications for the various schemes and offer you advice.

If you have any questions, you know where to find us!

Team Holthaus

General reminder

Dear relation,

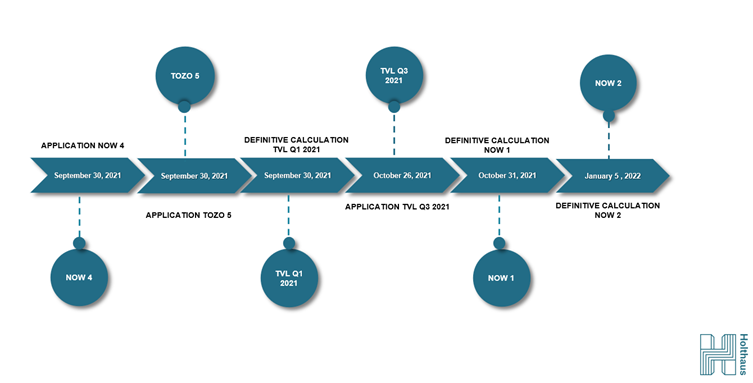

You can currently apply or calculate the support measures. Please keep the following deadlines in mind:

Please see our newsletter for an overview of all terms and conditions.

If you have any questions and/or comments, please let us know!

Team Holthaus

Would you like to apply for the TVL Q2 2021?

The Dutch government has decided to further expand the TVL (“Tegemoetkoming Vaste Lasten”, government contribution towards the fixed expenses for small and medium-sized businesses). The TVL helps entrepreneurs and self-employed persons with the payment of their fixed expenses. The TVL subsidy depends on the loss of revenue (which must be at least 30%), the fixed expenses percentage and a subsidy percentage.

Q2 now opened up

For many entrepreneurs, the reference period for the TVL Q1 2021, viz. the 1st quarter of 2019, was not representative. During this period, they realised little or no turnover due to the prevailing situation. As a result, they also received a lower TVL subsidy or no TVL at all. This is why then can choose between 2 different quarters (i.e. Q2 2019 or Q3 2020) as the reference period for the TVL Q2 2021.

In addition, the subsidy percentage will increase from 85% to 100%, while entrepreneurs who started their business between 15 March and 30 June 2020 can also apply for the TVL Q2 2021.

The requirements for the TVL Q2 2021 are set out below:

Eligibility requirements for the TVL Q2 2021

- The loss of revenue of your business must have been more than 30% in the 2nd quarter of 2021, compared to either the 2nd quarter of 2019 or the 3rd quarter of 2020.

- The fixed expenses must be at least €1,500 per quarter, based on the fixed expenses percentage established for your main activity.

- Your business must have been registered with a Dutch Chamber of Commerce on 30 June 2020 and must have an SBI code and at least one establishment in the Netherlands, with a front door that is separate from your home address. A number of exceptions apply to this establishment requirement, including for freight transport, the itinerant trade, fairground attractions, driving instructors and some types of cafes/restaurants.

Please note that if your calculated fixed expenses are less than €3,000 per quarter, you can now also apply for the TVL Q2 2021. You will receive the subsidy, if the fixed expenses are €1,500 or more. The calculated fixed expenses will be looked at, not the actual fixed expenses. For the calculation of the fixed expenses, RVO (the Netherlands Enterprise Agency) calculates the average share that the fixed expenses form of the revenue in your industry. This is referred to as “the fixed expenses percentage”. This means that you do not have to indicate what your actual fixed expenses were.

Would you like to apply for the TVL Q2 2021? You can submit your application up to and including 20 August 2021 at 05.00 p.m. via eHerkenning (eRecognition) (level 3) or DigiD. In order to be eligible for the extension of the TVL, an application must be submitted to the RVO for every period individually.

We would be glad to help you with your application for the TVL Q2 2021. Please let us know by 13 August at the latest whether we can assist you with this.

New VAT rules for Dutch entrepeneurs who deliver goods to consumers in other EU member states.

On 1 July 2021, the VAT rules for Dutch entrepreneurs who deliver goods and/or digital services to private individuals (without VAT numbers) in other member states will change. Are you delivering goods that are already in the EU and does the turnover that you realise with this in other member states exceed €10,000? In that case you need to charge the VAT of the member state where you have delivered the goods and/or digital services with effect from 1 July next. This foreign VAT must then be paid to the tax authorities in the country in which you realised the turnover.

In order to limit the administrative burden, use can be made of the One Stop Shop of the tax authorities. The foreign VAT can be declared and paid to other member states via this One Stop Shop on a quarterly basis. Your application for this One Stop Shop must be submitted before 1 July next.

If these new VAT rules apply to your business and the threshold of €10,000 is exceeded, it is important that your webshop, invoices and administration are adjusted. Are the new VAT rules applicable to your business or are you in doubt about this?

In that case please contact us as soon as possible!

TVL (contribution towards fixed expenses) for business start-ups - Q1 2021

In the 1st quarter of 2021, business start-ups are getting financial assistance via the TVL for Business Start-Ups (in Dutch: TVL Startende ondernemingen). This is a separate TVL subsidy scheme. The TVL for Business Start-Ups is meant for small and medium-sized businesses and also applies to self-employed persons who have a separate front door to their working area.

The level of the subsidy is based on the loss of revenue and on the fixed expenditure percentage that has been established for the SBI code of the main activity. As a starting entrepreneur in the Netherlands, you can apply for a subsidy for your fixed expenses if you fulfil the eligibility requirements for the subsidy.

Eligibility requirements for the subsidy

For the TVL for business start-ups, the following provisional requirements apply for Q1 2021:

- The business must have re-registered with the Trade Register of the Chamber of Commerce during the period from 1 October 2019 up to and including 30 June 2020.

- The business has an SBI code and is established in the Netherlands, but not at the home address. Exceptions apply to this establishment requirement, including for freight transport, itinerant trade, fairground attractions, driving instructors and some types of cafes/restaurants.

- The fixed expenditure of the business must be at least €1,500 per quarter. The RVO (Netherlands Enterprise Agency) calculates this with the fixed expenses percentage that has been established for the relevant SBI code.

- The business must have suffered a demonstrable loss of revenue in the 1st quarter of 2021 of 30% or more, compared to the revenue for the 3rd quarter of 2020.

- The minimum subsidy amount per quarter is €1,500.

- The maximum subsidy amount per quarter is €124,999.

- Is the business associated with or part of another business and thus part of an existing group? In that case you will not be eligible for the TVL for Business Start-Ups for the first quarter of 2021, if the registration date of any associated business within the group lies before 1 October 2019. Examples are:

- subsidiaries;

- operating companies;

- new branches that are starting up in a separate Dutch limited liability company;

- franchisees who are not independent of the franchisor.

- The business may not be a financial institution or a government enterprise.

- The business may not be bankrupt and may not have filed a petition for a postponement of payment (moratorium) with a District Court.

Additional requirement in the case of an application of €25,000 or more and a business registered in the period from 16 March up to and including 30 June 2020

Were you registered with the Trade Register of the Chamber of Commerce in the period from 16 March 2020 up to and including 30 June 2020 and are you applying for a subsidy of €25,000 or more? In that case your application must be accompanied by a statement made by an independent expert: an accountant, tax advisor or bookkeeper. The statement of an expert third party serves as an extra check of:

- The indicated loss of revenue;

- The actual existence of the business (a business may not be part of a group for which the registration date of any associated business in the group lies before 1 October 2019).

Would you like to apply for the TVL for Business Start-ups in Q1 2021? You can apply for the TVL for Business Start-Ups for Q1 2021 with effect from 31 May at 09:00 a.m. until 12 July at 05.00 p.m. Your application must be submitted via eHerkenning (eRecognition) (level 3) or DigiD.

We would be glad to help you with your application for the TVL for Business Start-ups for Q1 2021. Please let us know by 5 July at the latest whether we can assist you with this.

Deadlines Corona support measures March 2021

You can currently apply or calculate the support measures. Please keep the following deadlines in mind:

NOW 3.2: February 15, 2021 till March 15, 2021

NOW 3.3: May 17, 2021 till June 14, 2021

TVL Q1: February 15, 2021 till May 1, 2021

TVL Q2: To be expected as from the end of May till August 1, 2021

TOZO 3: October 1, 2020 till April 1, 2021

TOZO 4: April 1, 2021 till July 1, 2021

Definitive calculation NOW 1.0: October 7, 2020 till November 1, 2021

Definitive calculation NOW 2.0: March 15, 2021 till November 1, 2021

Definitive calculation TVL 1: End of February 2021 till April 1, 2021

Please see our newsletter for an overview of all terms and conditions.

If you have any questions and/or comments, please let us know!

Team Holthaus

Update most important Corona support measures december 2020

You can currently apply for the support measures. Please keep in mind the following deadlines:

- NOW 3.1: deadline à December 13, 2020

- TVL 2.1: deadline à January 29, 2021

- Tozo 3: deadline à March 31, 2021

The main terms of the named compensations are discussed below as there is an approaching deadline.

NOW 3.1

As with the first and second round of the NOW, a number of conditions remain the same. The most important conditions for applying for this compensation for the first period are listed below for you.

- There must be a decrease in turnover of at least 20%.

- The prohibition on making profit distributions to shareholders, bonuses to the board and the purchase of own shares will remain in place.

- The exemption percentage for the wage bill is 10% in the first period (1 Oct. to 31 Dec. 2020).

- The best efforts obligation aimed at training and the prohibition on the payment of dividends and bonus payments will remain for NOW 3.0.

- The fixed (fixed) surcharge for employer's contributions, such as holiday allowance, pension premiums and employer's premiums, remains 40%.

TVL 2.1

The most important conditions

for applying for the TVL 2.0 for the first period are listed below for you.

- The company must have more than 30% loss of turnover in the 4th quarter of 2020 compared to the 4th quarter of 2019.

- The fixed costs are at least € 3,000 in the 4th quarter of 2020, based on the percentage of fixed costs associated with the main activity of the company.

- In addition, the company must have at least one location other than the private address of the entrepreneur. With the exception of catering establishments and street trading.

- The company may have a maximum of 250 employees.

- The company must have been registered in the Trade Register of the Chamber of Commerce by March 15, 2020.

Please note! The TVL 2.0 is no longer dependent on the SBI-code of the company in the first period.

Tozo 3

The Tozo provides an additional benefit up to a maximum of EUR 1,512 net. You are may be eligible for the Tozo if:

- you have a household income below the social minimum as a result of the corona crisis and / or a liquidity problem for which you need a business credit;

- you worked at least 1,225 hours in your own company in 2019. If you started in your company after 1 January 2019, you must have worked on / in your company at for least 23.5 hours per week on average in the period between registration with the Chamber of Commerce and submitting the application 2020 (hours spend on administration and acquisition also count).

- If you want to apply for assistance to meet the need for working capital, no request has been submitted for a suspension of payments or for a declaration of bankruptcy for you, your household, your company or self-employed profession.

Consult our newsletter for an overview of all conditions!

We would like to know whether your company(-ies) meet the conditions set for one or more of the support measures and whether we can get started with the application for you. We again ask for a fixed fee of EUR 250 ex VAT for the application of the NOW 3.1 and Tozo 3 and EUR 275 ex VAT for the for the application of the TVL 2.1.

If you have any questions and/or comments, please let us know!

Most important Corona Support measures

Please find below an abridged version of our information email regarding the economic support measures and other relevant matters. The schemes to be discussed are:

- NOW (can be applied for with effect from 16 November 2020)

- Tozo (deadline: 30 November 2020)

- TVL (can be applied for with effect from 16 November 2020)

- Postponement of payment (deadline: 31 December 2020)

The most important measures are discussed below, because a deadline is nearing or because it is possible to submit applications for the scheme concerned.

Extension of NOW (Temporary Emergency Bridging Measure for Sustained Employment)

At the end of August, the Dutch government announced that the NOW scheme would be extended with three periods of three months each. This means that the NOW scheme has been extended until 30 June 2021. During these three periods, the compensation will be gradually reduced. For the determination of the total salary costs, the month of June 2020 will be used as the reference.

- Period 1 (1 October 2020 up to and including 31 December 2020): during this period the compensation will amount to a maximum of 80% of the total salary costs. Any salaries in excess of EUR 9,538 gross per month are not eligible for compensation during this period. The NOW compensation can be applied for in this period if the loss of revenue is at least 20%.

- Period 2 (1 January 2021 up to and including 31 March 2021): during this period the compensation will amount to a maximum of 70% of the total salary costs. Any salaries in excess of EUR 9,538 gross per month are not eligible for compensation during this period. The NOW compensation can be applied for during this period if the loss of revenue is at least 30%.

- Period 3 (1 April 2021 up to and including 30 June 2021): during this period the compensation will amount to a maximum of 60% of the total salary costs. Any salaries in excess of EUR 4,769 gross per month are not eligible for compensation during this period. The NOW compensation can be applied for during this period if the loss of revenue is at least 30%.

In the third round of NOW, employers may reduce their salary costs by a certain percentage without a resulting decrease in the NOW compensation.

- During the first period, the salary costs may be reduced by a maximum of 10%.

- During the second period, the salary costs may be reduced by a maximum of 15%.

- During the third period, the salary costs may be reduced by a maximum of 20%.

If the salary costs are decreased by larger percentages, there will be no NOW entitlement in respect of that part. The salary costs can be reduced in several ways: by not renewing fixed-term contracts, by laying off staff or through a voluntary salary reduction (“salary sacrifice”); such a salary sacrifice does require the employee’s consent and in this case it is wise to record the agreements made in writing.

If an application is made, 80% of the requested compensation is paid as an advance. In addition to the compensation for their salary costs, employers also receive a compensation for the monthly accrual of the holiday pay, pension contributions and employer’s contributions. This upcount is 40%. Profit distributions to shareholders, bonusses to directors and the redemption by companies of shares in their own capital are prohibited. Employers also have a duty to try and (re-)train their employees.

Would you like to apply for NOW? The application for the first period of NOW 3.0 can be made with effect from 16 November 2020 until 13 December 2020. The final determination of NOW 3.0 will take place in the summer of 2021.

Final determination of NOW

If you only applied for the NOW compensation for March, April and May (first NOW round) and you have received an advance, the final determination of the NOW compensation can be requested with effect from 7 October 2020. The date for the final determination of the second NOW round is yet to be announced. This means that if you applied for compensation in both the first and the second NOW rounds, you can only request the final determination later.

When the NOW is determined in retrospect, an auditor’s report or statement issued by a third-party expert may need to be submitted for the final determination of the compensation.

- If you received an advance in excess of EUR 100,000 or a fixed compensation in excess of EUR 125,000, an auditor’s report must be submitted.

- If you received an advance in excess of EUR 20,000 or a fixed compensation in excess of EUR 25,000, a statement issued by a third-party expert must be submitted. A third-party expert can, for instance, be an external consultant, external financier, industry organisation or auditor/tax advisor. As a registered tax advisor, Holthaus Advies can of course also prepare this statement.

- If no auditor’s report is required, the check will be made on the basis of the books and records.

Extension of the Tozo scheme (Temporary Benefit for Self-Employed Professionals)

Self-employed professionals can receive income support via Tozo in two ways.

- Income support up to the social minimum. This top-up does not have to be repaid. Self-employed professionals can top up their income up to a level of EUR 1,050 net per month. If both partners are self-employed, a maximum amount of EUR 1,500 net per month applies.

- In addition, a maximum loan of EUR 10,157 for business capital can be applied for at a reduced interest rate. The maximum term of this loan is 3 years, at an interest rate of 2%.

The government has extended the Tozo scheme by nine months, viz. up to and including 30 June 2021. In addition to the already existing “partner test”, a wealth test will be introduced starting with Tozo applications as per 1 April 2021. The wealth test will look at the immediately available resources. If a self-employed professional has more than EUR 46,520 in immediately available resources, there is no entitlement to Tozo 3. Immediately available resources include cash, bank and savings balances, shares, bonds and options. Other assets, such as an owner-occupied property, business equipment and stocks, are not included in the wealth test, as they are not immediately available resources. The wealth test will not apply in the period from 1 October 2020 up to and including 31 March 2021.

Would you like to apply for Tozo? Applications for Tozo can now be submitted to the municipalities. Please note: Tozo can still be applied for with retroactive effect to 1 October 2020 until 30 November 2020. If Tozo is applied for in December (or later), Tozo will apply with effect from the month in which the application was submitted.

Final determination of Tozo 1

If you have applied for Tozo 1, the municipality will ask you to submit a profit statement. The profit statement must specify the profit in respect of the period of Tozo 1. It is possible to change the period of the compensation when the profit statement is completed. Please note: the profit statement is mandatory. If it is not submitted, the Tozo benefit received may have to be repaid.

Extension of TVL (Contribution towards Fixed Expenses for Small and Medium-Sized Businesses)

Depending on the size of the business and the level of the fixed expenses and loss of turnover, businesses can receive a contribution towards their fixed expenses. The scheme has applied since 1 October 2020 and has been divided into three periods of three months each. This means that the TVL scheme will apply up to and including 30 June 2021. The maximum of this contribution is EUR 90,000 per period.

- Period 1 (1 October 2020 up to and including 31 December 2020): the loss of turnover must be at least 30% in order to be eligible for this contribution.

- Period 2 (1 January 2021 up to and including 31 March 2021): the loss of turnover must be at least 40% in order to be eligible for the contribution in this period.

- Period 3 (1 April 2021 up to and including 30 June 2021): the loss of turnover must be at least 45% in order to be eligible for this contribution.

The other conditions to be satisfied in order to be eligible for TVL are:

- The company must have been established and registered with the Chamber of Commerce prior to 16 March 2020.

- The business must have a Dutch branch.

- The business must have a physical establishment outside the entrepreneur’s home. For hospitality businesses and itinerant trade (such as driving schools, taxi transport and market traders) an exception applies: the business address may be the same as the home address there.

- No more than 250 people may be employed.

- The fixed expenses during a period of three months must be at least EUR 3,000.

- The business must have one of the required SBI codes eligible for TVL support. You can find these SBI codes here. Please note: for the first period (1 October 2020 up to and including 31 December 2020), the SBI codes will not be considered, which means that all businesses that satisfy the above requirements are entitled to TVL.

Would you like to apply for TVL?The application for this support can be submitted with effect from 16 November 2020 via the RvO website. The deadline is 21 January 2021. The application must be made through E-Herkenning or DigiD. In order to be eligible for the TVL extension, an application must be submitted to RvO for every period individually.

Hospitality business? In addition to the TVL, a once-only compensation of approx. EUR 2,500 applies to hospitality businesses. The subsidy amounts to 2.75% of the loss of turnover. This compensation must be applied for simultaneously with TVL, meaning that no additional request has to be made.

Event business? Because the summer months are the most important period for the events industry, the calculation of the TVL could be lower. This is why the government has introduced a top-up of the TVL for entrepreneurs in the events industry. More information about this scheme will follow soon.

Extension of postponement of tax payment and decrease in penalties and interest

Entrepreneurs who are facing financial difficulties due to the coronavirus can request a special postponement of tax payment until 31 December 2020. The postponement will end on 31 December 2020 at the latest. Please note that this is a postponement, not a waiver of the tax payment. The postponement applies to the following taxes:

- Personal Income Tax

- Corporate Income Tax

- Wage Tax

- Turnover Tax (VAT)

The collection and tax interest had been reduced to 0.01% until 1 October 2020. From 1 October 2020 up to and including 31 December 2020, the rate of the collection interest will continue to be 0.01%. The tax interest, however, was increased to 4% with effect from 1 October 2020. This applies to all types of tax, so also to Corporate Income Tax (normal rate: 8%). The remission of fines will apply only if a request for a postponement of payment has also been made. Old default fines will not be remitted and new default fines will be remitted only if they are caused by financial difficulties due to coronavirus.

Please note: with effect from 1 January 2021, new tax assessments must be paid within the normal payment periods.

Would you like to request a postponement?

For the Personal and Corporate Income Taxes, you will receive the assessment concerned after you have filed the tax return. For the Wage Tax and Turnover Tax (VAT), you will receive an additional assessment if you have not paid the tax within the normal period. Unfortunately, it is not possible to submit a request for a postponement in advance; you can only submit a written request for a postponement to the tax authorities after you have received an (additional) assessment. The deadline for requests for a postponement of payment is 31 December 2020.

A repayment period of three years will be introduced: from 1 July 2021 to 1 July 2024. Faster repayment is allowed of course. In the spring of 2021, the tax authorities will send letters in which a payment arrangement is proposed. Faster repayment is always possible of course.

Our services for you

We’ll keep a close eye on the above-mentioned measures and would like to inform you by email about the developments. If you wish, we can of course help you with the submission of applications for the various schemes. Feel to contact us if you have any questions and stay safe!

UBO-Register

Please note! This information doesn’t apply to the one man business (“eenmanszaak”), but is applicable to the Dutch limited liability company (“BV”) and the general partnership (“VOF”).

With effect from 27 September 2020, many organisations are required to register their UBOs in the new UBO Register held by the Dutch Chambers of Commerce.

What is a UBO?

The UBO (Ultimate Beneficial Owner) is the person who ultimately owns or controls a business, foundation or association (a “legal entity”).

In the case of a Dutch limited liability company (in Dutch: “BV”), UBOs are:

- persons owning more than 25% of the shares;

- persons holding more than 25% of the voting rights;

- persons who de facto control the business.

Why is a UBO Register being set up?

The UBO Register is an initiative of the European Union which is aimed at including the UBOs of companies incorporated in the Netherlands and other legal entities (see the enumeration below) in a central register and to make this register publicly accessible. With this European transparency measure, the EU seeks to combat money laundering and financing of terrorism.

After 27 September 2020, existing companies will have 18 months to register the information about their UBO/UBOs. Newly incorporated companies must immediately register their UBO/UBOs.

Which organisations have a registration obligation?

The registration obligation applies to the following entities:

- private limited liability companies (in Dutch: “BV’s”);

- public limited companies (in Dutch: “NV’s”);

- associations (in Dutch: “verenigingen”);

- mutual guarantee societies (in Dutch: “onderlinge waarborgmaatschappijen”);

- cooperative associations (in Dutch: “coöperaties”);

- professional partnerships (in Dutch: “maatschappen”);

- general partnerships (in Dutch: “VOF’s”);

- limited partnerships;

- shipping companies;

- SEs (European companies);

- SCEs (European Cooperative Societies);

- EEIGs (European Economic Interest Groupings);

Which organisations do not have a registration obligation?

No registration obligation applies to:

- one man businesses (in Dutch: “eenmanszaken”);

- listed companies and their 100% (direct or indirect) subsidiaries;

- Homeowners Associations (in Dutch: “VVE’s”); and

- associations with limited legal personality that do not run a business and legal persons created under public law.

In some cases, an exception can be granted for the registration obligation, viz. if registration would subject the UBO to the risk of fraud, kidnapping, blackmailing, violence or intimidation or if the UBO is a minor or is legally incapacitated otherwise.

Which information is registered and made publicly accessible?

The following UBO information will be made publicly accessible:

- name;

- month of birth;

- year of birth;

- state of residence;

- nationality; and

- nature and size of the interest held.

The documents submitted to the Chamber of Commerce, such as passports and partnership agreements, will not become publicly accessible.

For every UBO the following data can only be accessed by the Netherlands Financial Intelligence Unit (FIU-Nederland) and competent authorities, such as the tax authorities, FIOD (Netherlands Fiscal and Investigation Service) and AFM (Netherlands Authority for Financial Markets):

- BSN number;

- date of birth, place of birth, country of birth and home address.

These authorities can also access the documents submitted to the Chamber of Commerce.

What will happen if a business fails to (timely) register its UBO/UBOs?

The maximum penalty or fine to be forfeited by a business in the case of failure to (timely) register a UBO is EUR 21,750. It is also possible (in exceptional situations) that a prison sentence not exceeding two years is handed or that community service is ordered.

Do you need help?

If necessary, we can of course help you to register the UBO/UBOs. If you have any questions, you know where to find us!

Budget Day 2021: What are the consequences?

On Prinsjesdag (Prince’s Day, also known as Budget Day), the Dutch government announced its tax plans for 2021 and the consequences of the corona support measures. With this email we would like to inform you about the most important matters.

Measure to accommodate first-time property buyers

When a property is purchased, transfer tax is payable at a rate of 2%. That was and continues to be the main rule, but with effect from 1 January 2021, two exceptions apply.

The first exception concerns property buyers between the ages of 18 and 35: they are entitled to a once-only transfer tax exemption. The age limit is determined per buyer: if several persons buy a property jointly, the applicability of the exemption is determined for every buyer individually. For that matter, it does not have to be the buyer’s first owner-occupied property; the requirement is that the exemption has not been applied before.

The second exception is for buyers who are not going to live in the property they bought themselves. In that case, transfer tax must be paid at a rate of 8%. This, for instance, applies to a second home to be rented out to third parties, but also to a holiday home or a property parents buy for their children.

The criteria for the two exceptions are assessed at the time the notarial deed is executed. This means that the date on which the sale and purchase agreement is signed is not relevant for the amount of the transfer tax to be paid.

Income Tax rates

The rates of the Personal Income Tax in box 1 (earnt income and income from an owner-occupied residence) will be reduced stepwise. For the year 2021, a tax rate of 37.10% (2020: 37.35%) applies to incomes up to €68,507 and any income in excess of this amount is taxed at a rate of 49.50%, just as in 2020.

The effect of the general tax credit is that the income tax to be paid is lowered. In 2021, the general tax credit will be increased compared to 2020. In addition, the employed person’s tax credit (“arbeidskorting”) will also be increased. As a result of this increase, people who work (both employees and self-employed persons) will pay less income tax.

The tax credit for self-employed persons will be phased out in small steps in the years to come. This is aimed at reducing the tax differences between employees and self-employed persons. For 2020, the tax credit voor self-employed persons is €7,030 on an annual basis and with effect from 1 January 2021, this will be reduced to €6,670.

Certain deductions (including the mortgage interest reduction, tax credit for self-employed persons and the profit exemption for small and medium-sized businesses) can be deducted at a maximum rate of 43% in 2021 (in 2020: 46%).

Taxpayers must pay Personal Income Tax every year on their capital. In 2021, the rate will increase compared to 2020, but the capital that is exempted from tax will be increased. In 2020, capital is exempted from tax up to an amount of € 30,846 (this exemption applies per person); this amount will be increased to €50,000 in 2021.

Entrepreneurs or employees who also use the company car for private purposes pay tax (indirectly, via an addition to their income/salary that is subject to Wage Tax or Personal Income Tax), based on the list price of their car. The normal percentage of the addition is 22%, but for all cars with zero CO2 emissions a lowered percentage of 12% applies (in 2020: 8%). This lower rate applies up to a list value of €40,000, for the excess the general percentage of 22% applies. This maximum list value does not apply to hydrogen cars or solar cell cars.

Allowances

With effect from 1 January 2020, a fiscal partner is no longer ‘allocated’ for the whole allowance year, but only with effect from the first day of the month after the tax partnership arose. A tax partnership may, for instance, arise if partners purchased a house together, had a child or got married. This measure means, in concrete terms, that a tax partnership arising later in the year does not necessarily mean that allowances received earlier in the year (for instance the housing allowance, care allowance and childcare allowance) have to be repaid.

Corporate Income Tax

In 2021 the rates for the Corporate Income tax for profits up to €245,000 (in 2020: up to € 200,000) will be reduced to 15%. Just as in 2020, the excess will be taxed at a rate of 25%.

If companies realise profits with certain innovating activities, a reduced rate may apply based on the “innovation box”. More specifically, this means that less Corporate Income Tax will be payable. The rate for the innovation box has been fixed at 9% with effect from 1 January 2021 (in 2020: 7%).

Dividend tax

In 2020, dividends distributed to a shareholder (which is not a private limited liability company, a “BV”) are subject to dividend tax at a rate of 26.25%. This will be increased to 26.9% in 2021. On the other hand, the Corporate Income Tax rate will be reduced (see above).

Employment costs scheme

The “free space” of the employment costs scheme (“werkkostenregeling” or WKR) is normally 1.7% of the fiscal salary sum for the first €400,000 of the fiscal salary sum. As an exception due to the corona crisis, the free space is, only in 2020, 3% of the total fiscal salary sum for the first € 400.000 of the fiscal salary sum.

Tax consequences of corona subsidies

The Emergency Counter scheme (“TOGS”) enabled businesses to claim a compensation for the damage suffered as a result of the measures to combat coronavirus, provided certain requirements were satisfied. This scheme was followed by the TVL, a scheme enabling small and medium-sized businesses to receive a compensation for their fixed costs. Both forms of compensation are not part of the business profits, so no tax has to be paid on the amounts received under TOGS or TVL.

The TOFA scheme (Temporary Bridging Scheme for Flexible Employees) provided for a compensation as a contribution towards the cost of living. UWV (Employee Insurance Agency) will already have withheld tax from the compensation, but the general tax credit (“heffingskorting”) will also have been routinely applied. If several payments were received under TOFA or wages were received from more than one employer in 2020, additional tax may have to be paid via the Personal Income Tax return. The reason for this is that the general tax credit that has been applied was too high on balance. In addition, TOFA may effect people’s personal allowances (for instance, the care allowance, childcare allowance and housing allowance).

Under NOW (Temporary Emergency Bridging Measure for Sustained Employment), entrepreneurs could claim compensation for their wage costs. NOW is part of the business revenues and is therefore subject to Personal Income Tax (if the business is run in the form of a one-man business or partnership) or Corporate Income Tax (if the business is run in the form of a private limited liability company (BV)).